“Decoding Your Health Insurance Plan: A Beginner’s Guide”

Navigating the world of health insurance can often feel like trying to decode a complex language. With an array of terms, conditions, and rules, understanding your health insurance plan is crucial to making the most of it. This beginner’s guide aims to demystify health insurance, helping you to understand your plan better and make informed decisions about your healthcare.

Understanding Basic Health Insurance Terms

Before diving into the specifics of your plan, it’s essential to familiarize yourself with some common health insurance terminology:

– Premium: This is the amount you pay for your health insurance every month, regardless of whether you use medical services.

– Deductible: The deductible is the amount you need to pay out-of-pocket for covered healthcare services before your insurance plan starts to pay.

– Copayments and Coinsurance: These are your share of the costs for a covered healthcare service. A copayment (or copay) is a fixed amount (for example, $20) you pay for a covered service, while coinsurance is a percentage (like 20%) of the cost of the service.

– Out-of-Pocket Maximum: This is the most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance, your health plan pays 100% of the costs of covered benefits.

– Network: This refers to the facilities, providers, and suppliers your health insurer has contracted with to provide healthcare services.

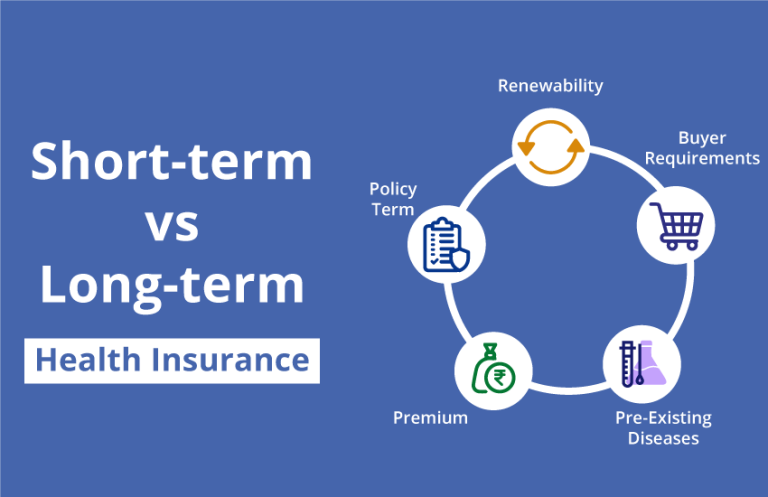

Types of Health Insurance Plans

There are several types of health insurance plans, and each works differently:

– Health Maintenance Organization (HMO): These plans usually limit coverage to care from doctors who work for or contract with the HMO. They generally won’t cover out-of-network care except in an emergency.

– Preferred Provider Organization (PPO): PPOs give you the choice of getting care within or outside of a provider network. Using network providers generally costs you less.

– Exclusive Provider Organization (EPO): An EPO plan is a mixed model, offering some flexibility to use providers outside the network but often at a higher cost.

– Point of Service (POS): These plans combine features of HMOs and PPOs. You typically need a referral to see a specialist.

Reading Your Summary of Benefits and Coverage

Every health plan must provide a Summary of Benefits and Coverage (SBC), which is a standardized document that outlines the key features of the plan, including covered benefits, cost-sharing provisions, and coverage limitations. Reviewing the SBC can help you understand what your plan covers, what it doesn’t, and how much you can expect to pay for various services.

Know Your Network

Understanding your plan’s network is crucial. Going out-of-network can result in higher out-of-pocket costs or no coverage at all. Always check if your preferred doctors and hospitals are in-network and understand the costs associated with using out-of-network services.

Preventive Services

Most health insurance plans are required to cover a set of preventive services — like shots and screening tests — at no cost to you. Knowing these can help you take advantage of necessary health screenings and vaccines.

Managing Costs

Understanding how to manage your healthcare costs is vital. Always review medical bills and Explanation of Benefits (EOB) statements for accuracy. Utilize preventive care services, as these are often covered at 100%. If you have prescriptions, see if your plan has a mail-order pharmacy option, which can be cheaper.

Appealing Decisions and Asking for Help

If a claim is denied, you have the right to an appeal. The process for appeal will be outlined in your plan’s materials. Additionally, most plans offer customer service that can provide guidance and answer specific questions about your coverage.

Conclusion

Understanding your health insurance plan is key to making informed healthcare decisions and avoiding unexpected medical bills. By familiarizing yourself with the basic terms, knowing the details of your specific plan, and being proactive about your healthcare expenses, you can take control of your health and wellbeing. Remember, the more you know about your health insurance, the better equipped you’ll be to navigate the healthcare system effectively.